What Is an Independent Contractor?

Independent contractors, sometimes called 1099 contractors or "freelance" workers, are those in a work arrangement where the individual is self-employed and chooses to complete contract work according to their own schedule and interests. This differs from a regular employment arrangement where an employer assigns schedules and duties. The term "1099" refers to the tax form that is used to report the income earned through independent contract work.

School districts and large substitute teaching companies often hire substitute teachers as W2 employees. In these arrangements, substitutes are able to access certain benefits depending on work minimums, but they are not independent and are given assigned work schedules.

On the other hand, substitute teachers who work as independent contractors are self-employed, keeping the power to make decisions on when to work, where to work, what price to charge or accept, and even the option to work with multiple companies and schools. Senya does not employ substitutes; Senya runs a technology platform designed for freelance substitutes to search and arrange job opportunities with schools.

When you sign the contractor Agreement, you gain access to substitute job opportunities through the company platform. However, you do not work for Senya; you retain all decisions about your work schedule, and you are free to contract with other individuals and companies.

What are the benefits of working through a 1099 contract?

There are several reasons why people enjoy working as independent contractors!

Independence

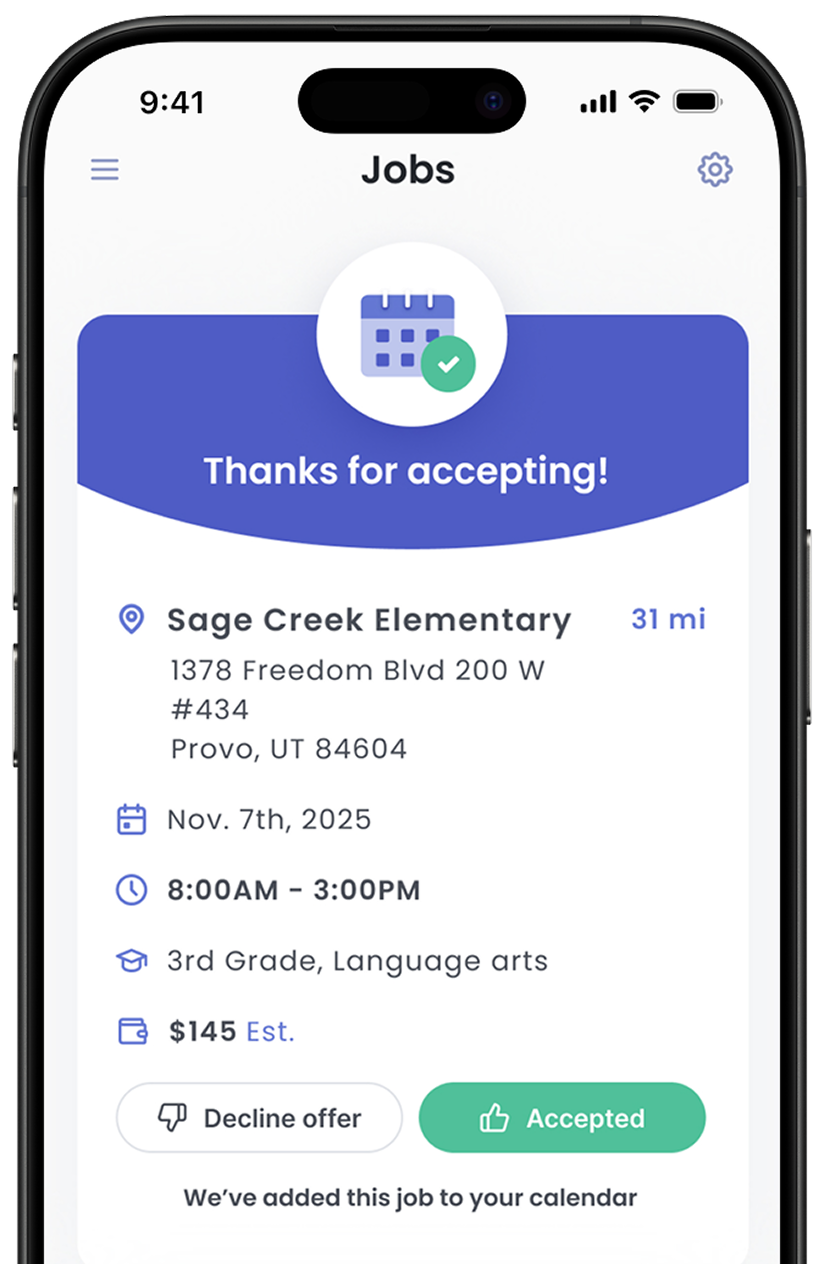

1099 contractors are not employees of a company. Instead, you operate as a self-employed individual or freelancer. You have control over how, when, and where you complete your work. On the Senya platform, you are not assigned to schools but rather get to browse work opportunities and choose the dates and locations that you are interested in working.

Flexibility

One of the main benefits of being a 1099 contractor is the flexibility it offers. As a contractor, you can work for multiple schools or companies, choose the work opportunities that fit your interests, and determine your work schedule. Your contract to use the Senya platform is not exclusive, and in fact, any work that you arrange through the Senya platform can increase your marketability for other job opportunities.

Career Opportunities

Being an independent contractor is a great way to gain experience in a job field that you are interested in. As a contractor doing substitute teaching, you can explore what it is like to work in schools and see if you want to pursue something permanent down the road. You also have the flexibility to work at a variety of school campuses, so you can see what schools would be a good fit if you moved into an education career. Plus, you have an inside track to being hired! Now more than ever, schools are hiring substitutes for permanent positions. As you build strong relationships with schools, you will be a top candidate for full-time openings!

What are the tax implications of working through a 1099 contract?

Senya, nor its team members, are qualified to give tax advice. The general information shared below is based on published reference material, but it is not a substitute for meeting with a tax professional or doing your own detailed study of tax requirements.

Withholdings

As an independent contractor, you are responsible for withholding taxes on your income and purchasing any insurance you are required and interested in holding. Senya does not withhold any taxes nor provide any insurance or other benefits for independent contractors using the platform.

Self-Employment Tax

Independent contractors are considered "self-employed," so you will not only pay personal income tax but also the self-employment tax, which is 15.3% for the years 2023 and 2024. This tax covers Social Security and Medicare, so it is similar to the taxes withheld from wage earners in other forms of employment.

Annual 1099 Statement(s)

Any company that you work with as an independent contractor should issue you an annual 1099 tax statement if you earn $600 or more during the year. Senya facilitates payment through the provider Everee, and they typically issue the form on January 31st of each new year. If you earned less than $600 from any specific company, they do not have to (but may) provide you with a 1099 statement; however, you are still required to report all 1099 income on your tax filing.

Deductions

You may be able to deduct expenses related to your independent contract work. It is recommended that you talk with a tax professional or consult with reputable online sources to determine what/how much you might be able to deduct. As a general guide, independent contractors are able to deduct any expenses that are directly related to work.

Some examples for substitute teachers include

- fuel expenses (based on car mileage driving to and from schools)

- phone bill (a percentage based on how much it is used to conduct work)

- insurance for work purposes

- tax preparation costs

The goal of deductions is to lower the taxable amount of your 1099 income, so if you have $1,000 worth of deductions, you would save $153 (based on the 15.3% self-employment tax rate). A tax professional can help you determine if it is worthwhile to pursue deductions and what evidence, such as receipts, you might need to submit.

.png)